Categories

Home BuyersPublished November 24, 2025

Most Experts Are Not Worried About a Recession: What That Means for Today’s Housing Market Trends

Opening Question:

Are concerns about a possible recession supposed to change the way you approach today’s housing market trends?

Snippet Answer:

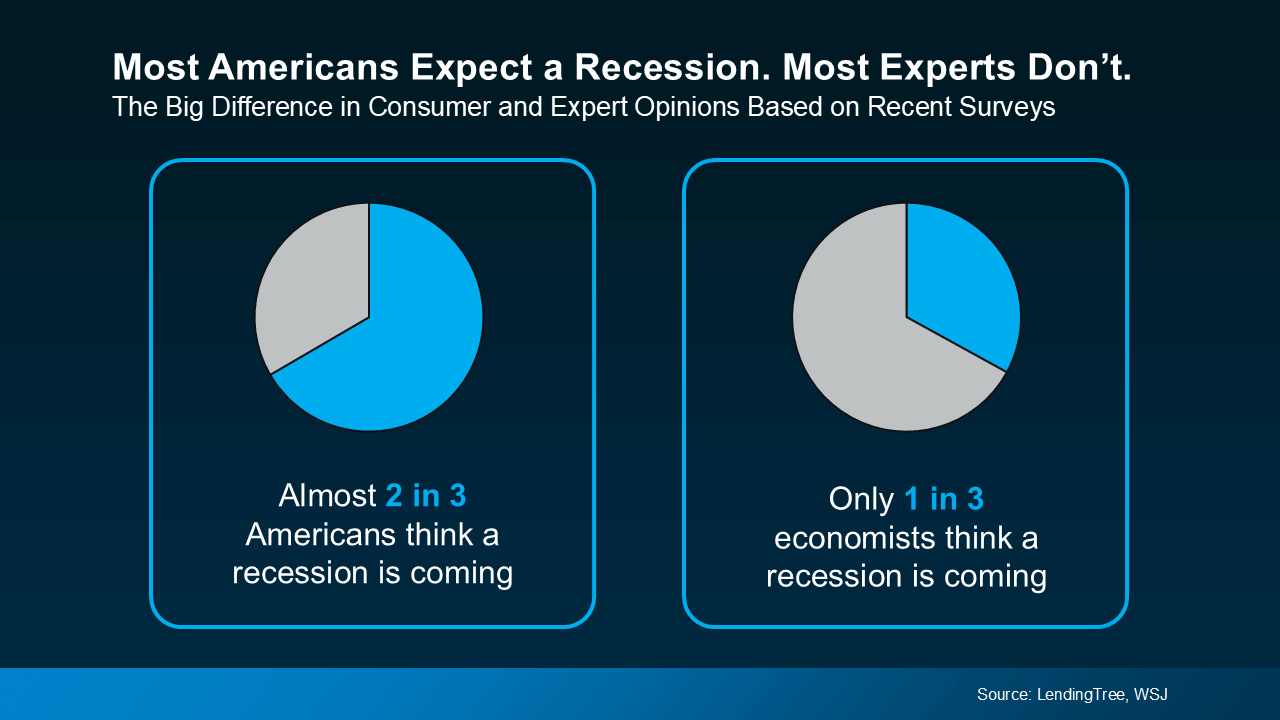

Most Americans expect a recession, but most economists don’t. When you look at housing market trends through actual data instead of fear-driven headlines, the picture becomes far clearer—and far more encouraging for buyers considering a move right now.

Why Consumer Sentiment and Expert Forecasts Don’t Match

If you’ve felt unsure about jumping into the market, you’re not alone. Buying a home is one of the biggest financial decisions you’ll ever make, and recession chatter tends to amplify every doubt. A recent LendingTree survey shows nearly two-thirds of Americans believe a recession is coming, and 74 percent say that belief is influencing their financial choices.

Yet expert economists—who analyze housing market trends daily—aren’t ringing the same alarm bells.

According to an October Wall Street Journal report, only one in three economists predict a recession in the next 12 months. That’s a significant contrast from consumer expectations and a strong indicator of how sentiment doesn’t always mirror data.

Many headlines thrive on uncertainty, but uncertainty is not a forecast. It’s simply the space between what people fear and what experts can actually verify. You’re not in a recession today, and there’s no clear evidence one is imminent.

Understanding this gap helps you make decisions rooted in facts, not the noise of the moment. When you’re ready to talk through what this means for your plans, you can schedule a call to get personalized guidance.

What Housing Market Trends Look Like in an Uncertain Economy

Market uncertainty doesn’t automatically equal financial danger. The best way to navigate shifting economic conditions is by looking at the fundamentals that drive real estate decisions.

Housing demand remains steady because people move for real-life reasons—family changes, job transitions, lifestyle needs, and long-term planning. Danielle Hale, Chief Economist at Realtor.com, has said that buyers with strong personal motivations tend to act regardless of short-term economic headlines. These underlying motivations anchor the market even when sentiment fluctuates.

Homes are still selling. Buyers are still buying. And the overall market is adjusting, not collapsing.

If you’re considering a move, you don’t have to figure it out alone. You can always reach out to explore your options and understand which trends matter most for your situation.

What Buyers Should Focus On Right Now

If you’re preparing to buy in today’s market, a few core principles can help you navigate confidently.

Prioritize job stability

Job security is one of the strongest predictors of whether you’re ready to buy during an uncertain period. A steady income and reliable employment provide the foundation for a comfortable mortgage payment, even as market conditions shift.

Build and maintain a financial cushion

Savings are more than a safety net—they’re a buffer against fluctuations. This includes being prepared for evolving costs like insurance premiums or property taxes. When you understand your full financial picture, you’re better equipped to move forward without stress.

Set a realistic, sustainable budget

Redfin economists emphasize staying within a budget that aligns with your goals and long-term plans. Your price point shouldn’t stretch your comfort zone, and your monthly payment should leave room for life to happen.

Negotiate strategically

More homes are available today than in the ultra-tight markets of the past few years. That creates negotiating space—on price, repairs, closing costs, or timing. A thoughtful negotiation strategy can unlock meaningful savings.

If you want help mapping out your purchase strategy, you can schedule a call whenever you’re ready to talk through your goals.

Mortgage Insights: Why Today’s Rates Require Strategy

Mortgage rates have been the biggest headline grabber of the past year. They affect monthly affordability, buyer demand, and overall market confidence. But rates are fluctuating—not locked into a permanent upward path.

Instead of trying to time the market, focus on what you can control:

• Know what monthly payment feels comfortable.

• Ask lenders about rate options, payment strategies, and potential refinancing opportunities if rates dip later.

• Understand how rate changes affect your long-term goals.

A clear plan helps you buy based on affordability, not fear of “missing the perfect moment.” If you want to run a payment scenario or compare rate paths, you can connect anytime for a one-on-one review.

Should You Sell Before You Buy?

If you currently own a home, selling first may bring clarity to your purchase. It reduces financial pressure, eliminates surprises, and creates a defined budget for your next move. Some homeowners prefer to buy first for convenience, but in times of economic uncertainty, knowing exactly where you stand can offer meaningful peace of mind.

A conversation about timing can help you understand which approach fits your financial goals and market readiness.

Why Working With a Local Expert Matters More Right Now

During uncertain times, expert guidance becomes especially valuable. As Bankrate notes, buying a home in any shifting economy can still be a smart move for people with stable finances—but only with the right support. Local agents bring insight into neighborhood trends, pricing behavior, listing conditions, and opportunities you won’t always see online.

Your agent isn’t just there to facilitate a transaction. They’re there to help you navigate one of the most important financial decisions of your life with clarity and confidence.

As part of The McClung Group in The Woodlands, you get a full team behind you—local expertise, strategic negotiation, and a steady voice when the headlines feel noisy. And whenever you want clarity about your next step, you can schedule a consultation to talk it through.

Bottom Line

Most Americans believe a recession is on the horizon, but most economists don’t. The housing market is influenced by real-world needs, stable demand, and long-term financial fundamentals—not just public sentiment.

If you have stable employment, solid savings, and a genuine need to move, you don’t have to put your plans on hold. You can buy with confidence when you understand the trends and have the right support behind you.

When you’re ready to explore your options, schedule a call and get expert guidance tailored to your goals.

Call to Action

Ready to understand your next move in today’s housing market trends?

Schedule a call today, and let’s walk through your goals and what makes the most sense for your timing, budget, and long-term plans.

.png)