Categories

Home Buyers, Home SellersPublished October 8, 2025

Why Experts Say Mortgage Rates Should Ease Over the Next Year

.png)

Will mortgage rates finally come down—and stay down?

Experts say there’s real potential for lower rates ahead. In fact, several key market indicators suggest we may see meaningful easing through the next year—potentially into the upper-5% range by late 2026.

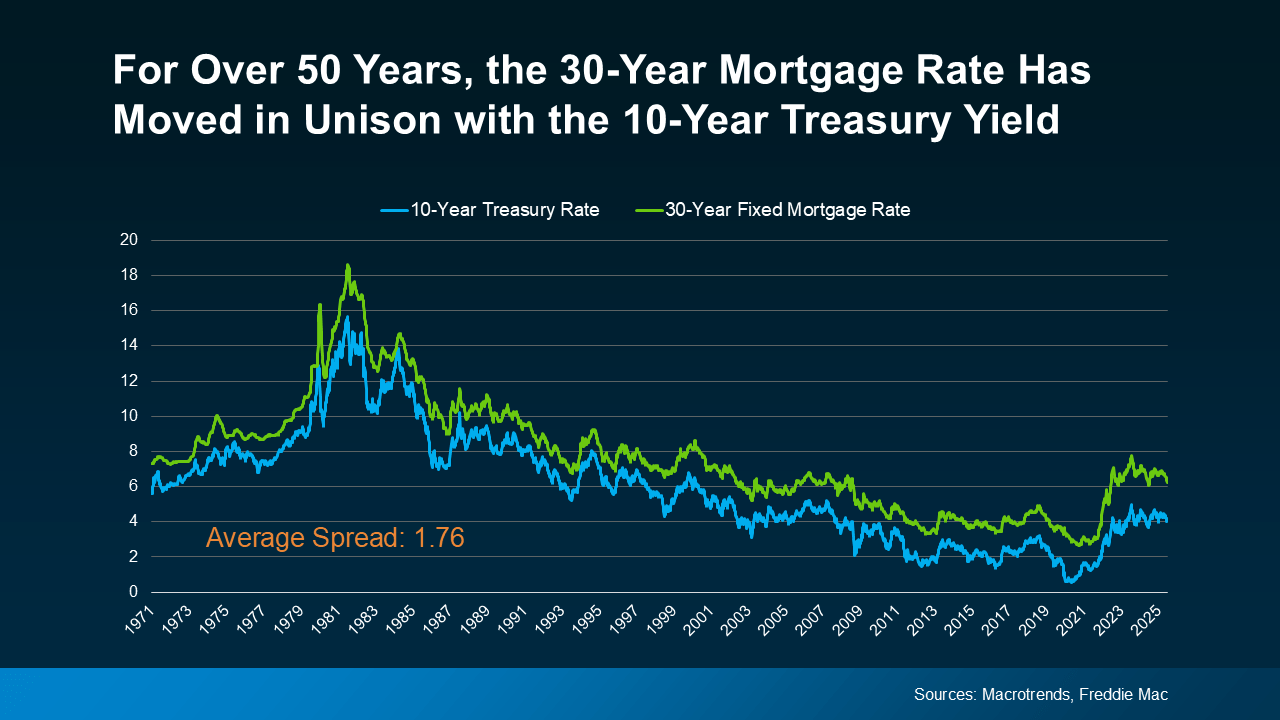

The Link Between Mortgage Rates and the 10-Year Treasury Yield

For over 50 years, the 30-year fixed mortgage rate has closely followed one major benchmark: the 10-year Treasury yield. When the Treasury yield climbs, mortgage rates tend to follow. When the yield drops, mortgage rates typically fall too.

This relationship is so consistent that experts even track the difference between the two—a number called the spread. Historically, that spread averages about 1.76 percentage points (176 basis points).

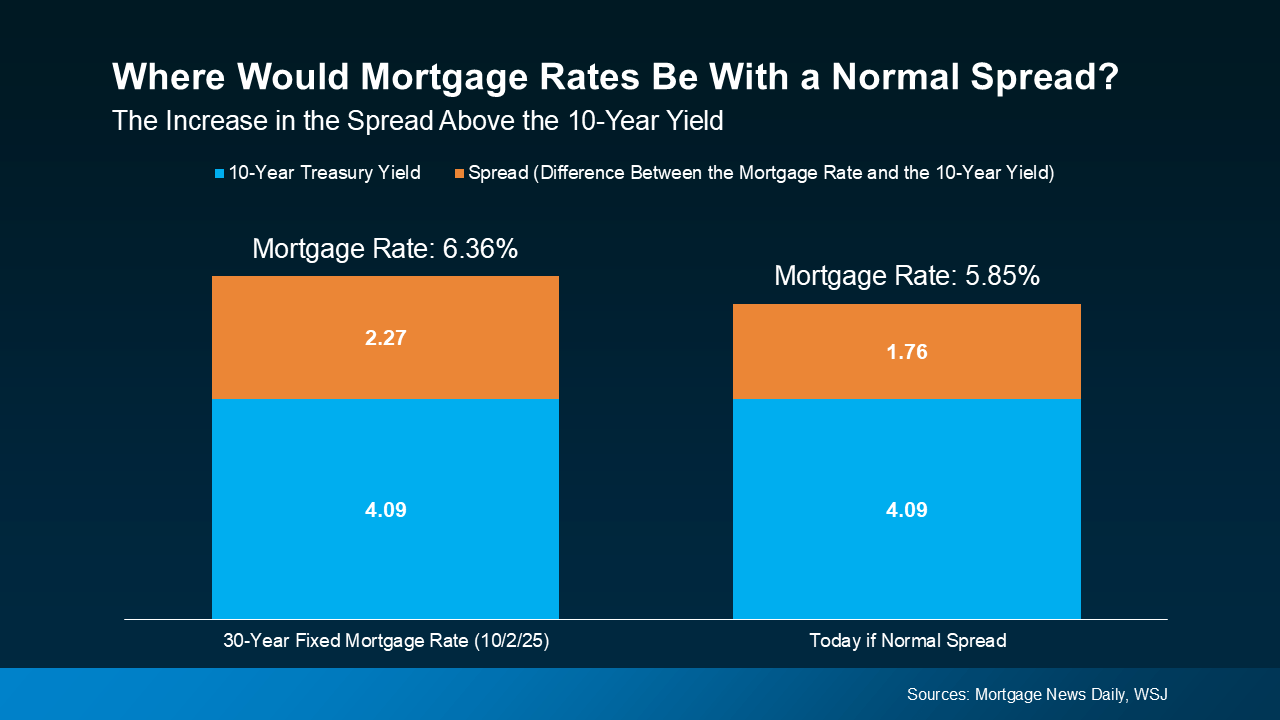

So, if the 10-year Treasury yield sits at 4.09%, you’d expect mortgage rates to hover near 5.85%. It’s a simple but powerful equation that gives experts insight into where rates may head next.

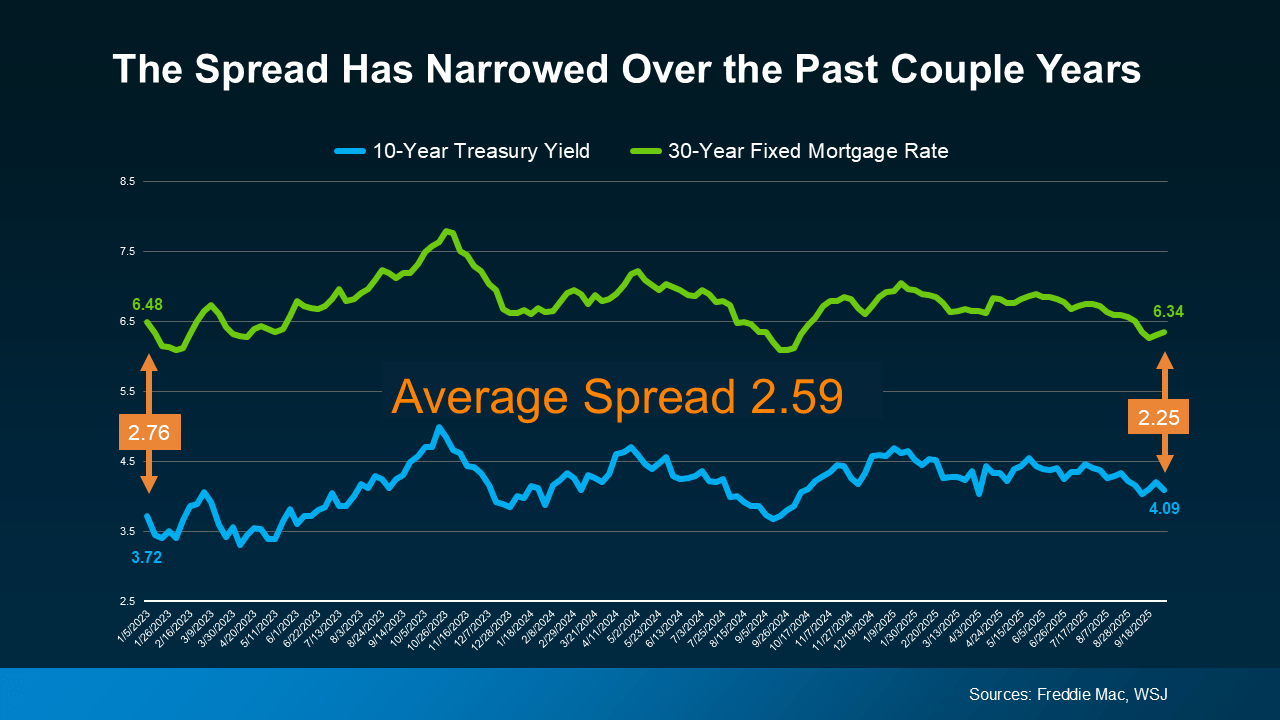

The Spread Is Shrinking—And That’s a Good Sign

Over the past two years, that spread has been much wider than normal. The reason? Market uncertainty. When investors fear economic instability, they demand higher returns on mortgage-backed securities, widening the spread and pushing mortgage rates up.

But here’s where optimism returns: the spread is now narrowing. As economic conditions stabilize and the path forward becomes clearer, investor confidence improves—and the gap between mortgage rates and the Treasury yield tightens.

As Redfin recently explained, “A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

The 10-Year Treasury Yield Is Expected To Decline

It’s not just the spread that’s moving in a favorable direction. Many analysts expect the 10-year Treasury yield itself to continue easing into next year. That combination—a declining yield and a narrowing spread—creates the potential for meaningful relief in mortgage rates through 2026.

While there will always be short-term fluctuations based on inflation, employment reports, and Federal Reserve policy, the long-term indicators are beginning to align in buyers’ favor.

What This Means for Buyers and Sellers in The Woodlands

For anyone planning to buy or sell in The Woodlands, this trend is worth watching closely. Lower mortgage rates could open new opportunities for both sides of the market:

-

Buyers may see improved affordability and stronger purchasing power.

-

Sellers could benefit from increased buyer activity and confidence.

It’s a delicate balance, and local conditions will always play a role—but if the projections hold, 2026 could be a more balanced and active housing market overall.

The Bottom Line

Keeping up with shifting mortgage rates and economic headlines can feel overwhelming. That’s where working with a knowledgeable local expert makes a difference.

The McClung Group keeps a close eye on these trends to help you make confident, informed decisions in any market.

If you’d like real-time insights on mortgage rates or want to discuss how these changes could impact your buying or selling plans, schedule a call today—we’ll help you plan your next move with clarity and confidence.

.png)