Categories

Home Buyers, Home SellersPublished September 19, 2025

What a Fed Rate Cut Could Mean for Mortgage Rates

Will a Federal Reserve rate cut lower mortgage rates?

Not directly—but the Fed’s moves can still influence the direction of mortgage rates, and knowing how that works can help you make smarter real estate decisions.

The Fed Doesn’t Directly Set Mortgage Rates

When you hear news about the Federal Reserve cutting rates, it’s easy to assume that mortgage rates will immediately follow. But that’s not how it works.

The Federal Funds Rate is the short-term interest rate banks charge each other to borrow money. It affects borrowing costs across the economy—like credit cards, auto loans, and business financing—but it’s not the same as mortgage rates.

That said, the Fed’s actions influence investor confidence, financial markets, and the overall economy—all of which play a role in shaping mortgage rate trends.

Why Markets Already Saw This Cut Coming

Here’s the key detail: mortgage rates often move before the Fed officially makes a decision. That’s because markets price in what they expect will happen.

When weaker-than-expected jobs reports came out on August 1 and September 5, markets grew more confident the Fed would cut rates. Mortgage rates ticked down in response, even though the Fed hadn’t acted yet.

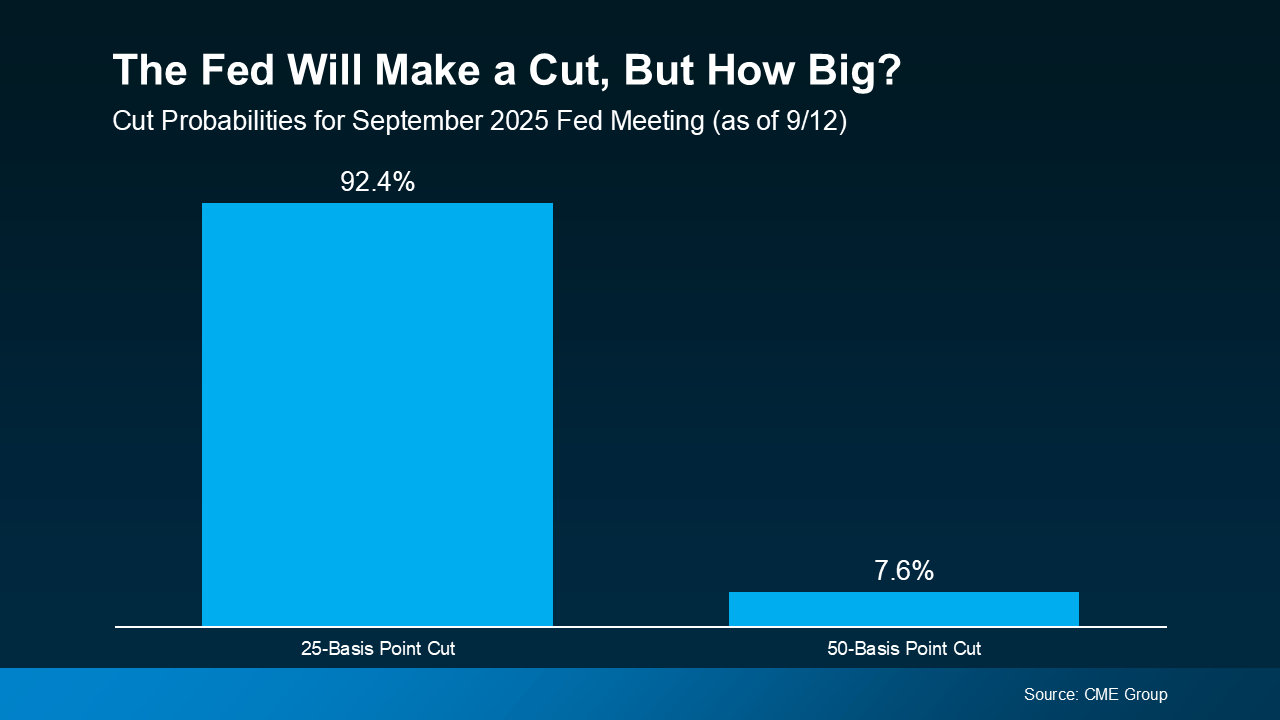

So if the Fed makes a 25-basis point cut—the move most economists expect this September—it’s likely already “baked in” to today’s mortgage rates. But if the Fed surprises with a larger 50-basis point cut, we could see mortgage rates come down more noticeably in the short term.

What Experts Are Saying About What’s Next

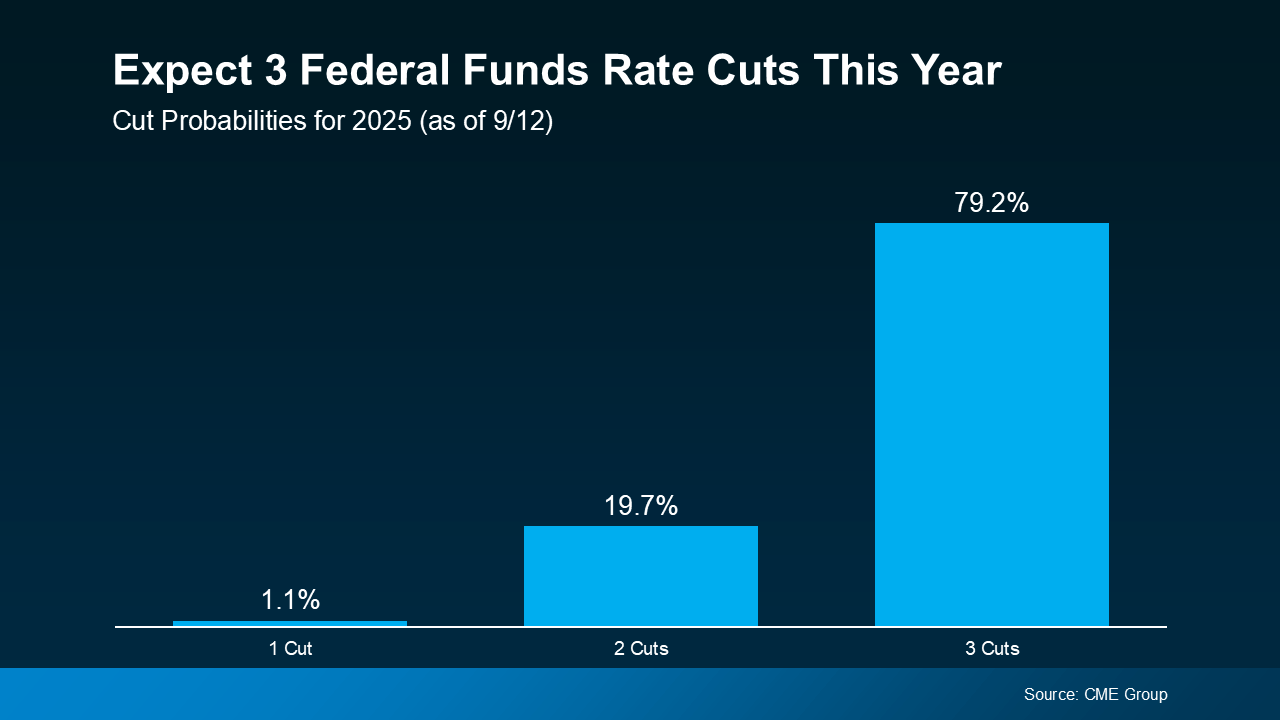

Many housing economists believe the September cut won’t be the last one. If the economy continues cooling, the Fed could cut rates multiple times before the end of the year.

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

In other words, mortgage rates may not drop sharply overnight, but if investors believe the Fed will continue cutting, rates could trend lower over the coming months and into 2026.

What This Means for Buyers and Sellers in The Woodlands

For buyers, even a modest dip in mortgage rates can make a meaningful difference in monthly affordability. If rates fall further later this year, you may be able to purchase more home for the same budget—or simply enjoy a lower payment on the home you’ve already been eyeing.

For sellers, a gradual easing in rates could bring more buyers into the market. Increased affordability means stronger demand, which can help your listing stand out in The Woodlands’ competitive housing market.

The Bottom Line

A Fed rate cut won’t move mortgage rates one-for-one, but it does set the tone for what’s ahead. The real opportunity lies in understanding these shifts and acting strategically.

At The McClung Group, we stay on top of these trends so you don’t have to. Whether you’re buying your first home, moving up, or planning to sell, having a clear strategy is the key to making the most of today’s market.

Ready to Talk Strategy?

Even small changes in rates can have a big impact on your affordability and options. Let’s connect and discuss how these moves could affect your next step in real estate.

👉 Schedule a call with The McClung Group today to plan your best move in The Woodlands market.

.png)