Categories

Home BuyersPublished October 22, 2025

The $280 Shift in Affordability Every Homebuyer Should Know

Is housing finally getting more affordable in The Woodlands?

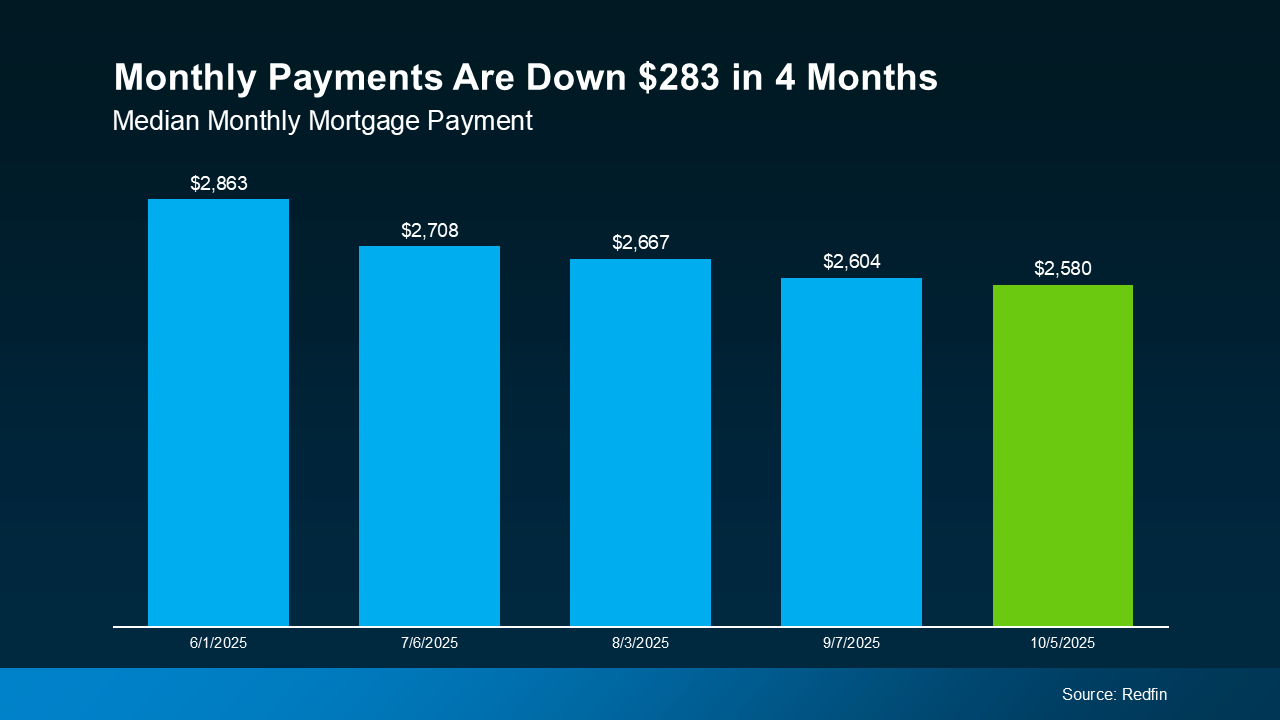

Yes — and it’s a welcome change. Over the past several months, home affordability has quietly improved across much of the country, including right here in The Woodlands. With mortgage rates easing and price growth moderating, the typical monthly payment on a new home is now about $283 lower than it was just four months ago, according to Redfin.

That may not sound like much at first, but the difference adds up fast — and it’s reshaping what many buyers can afford this fall.

Housing Affordability in The Woodlands Is Improving

After a few tough years for buyers, affordability is finally trending in the right direction. According to First American, 39 of the top 50 housing markets in the U.S. have seen measurable improvement in affordability. That marks five straight months of progress — something buyers haven’t seen since before the pandemic boom.

Here’s what’s driving the change:

-

Mortgage rates have eased from their 2025 highs

-

Home price growth has slowed in many metro areas, including parts of Montgomery County

-

Buyer competition has cooled, giving you more leverage and time to make decisions

Put simply, the math is shifting in your favor.

Mortgage Payments Are Down — and That Matters

The latest Redfin data shows the median monthly mortgage payment has dropped from $2,863 in June 2025 to $2,580 in October 2025.

That’s a $283 monthly savings — or roughly $3,400 a year back in your pocket.

While this shift doesn’t erase the affordability challenges entirely, it gives buyers meaningful breathing room. A few hundred dollars a month could mean the difference between stretching your budget and feeling comfortable with your payment.

Even more importantly, it could expand your price range. Redfin notes:

“A borrower with a $3,000 monthly budget can now afford a $468,000 home — about $22,000 more than in June.”

That’s the kind of flexibility that can help you find the right home without overextending yourself financially.

What’s Behind the Change

Two main forces are driving this new wave of buyer opportunity:

-

Mortgage rates are easing.

Rates have trended lower since midyear as inflation pressures cooled and the Federal Reserve signaled a more balanced outlook. Every fraction of a percentage point makes a difference when it comes to your payment. -

Home price growth is stabilizing.

Prices in The Woodlands and surrounding areas aren’t falling dramatically — but they’re no longer rising at the breakneck pace of 2021–2022. This moderation helps affordability improve, even if rates fluctuate slightly.

As Andy Walden, Head of Mortgage and Housing Market Research at ICE Mortgage Technology, explains:

“The recent pullback in rates has created a tailwind for both homebuyers and existing borrowers. We’re seeing affordability at a 2.5-year high.”

What It Means for Buyers in The Woodlands

If you’ve been sitting on the sidelines, now’s the time to reassess your numbers.

With rates easing and prices stabilizing, you may qualify for more home than you could earlier this year — or find that the payment on the home you wanted now fits your budget. Whether you’re a first-time buyer or ready to move up into your next home, housing affordability in The Woodlands is better than it’s been in quite a while.

Here’s how to make the most of this moment:

-

Revisit your pre-approval. Lenders update rate quotes regularly, and your new estimate could surprise you.

-

Explore different price points. The same monthly budget could now buy more home.

-

Consider locking a rate soon. If you find a home that fits your needs, today’s rates could save you thousands compared to earlier this year.

Bottom Line

Affordability is improving, and that resets the math on your move. For many buyers, this shift is the green light they’ve been waiting for.

If you’ve been holding off because rates or payments felt too high, let’s take another look together. The numbers may look very different now — and those savings could make your next move possible.

Schedule a Consultation

Ready to see how far your budget can go in today’s market? The McClung Group, REALTORS® in The Woodlands, TX can help you break down the numbers and explore your options with clarity and confidence.

Schedule your consultation today and discover what your next move could look like.

.png)