Categories

Home BuyersPublished September 12, 2025

Mortgage Rates Just Saw Their Biggest Drop in a Year

Are mortgage rates finally moving in your favor?

Yes—last week they dropped in a big way. On Friday, September 5th, the average 30-year fixed mortgage rate fell to its lowest level since October 2024. It was the single largest one-day decline in over a year, giving hopeful buyers in The Woodlands and beyond a reason to pay close attention.

What Sparked the Drop?

According to Mortgage News Daily, this sudden shift came after the August jobs report showed weaker-than-expected results for the second month in a row. That triggered reactions in the financial markets, which in turn brought mortgage rates down.

In simple terms, signs of a slowing economy often bring lower mortgage rates. As markets gain clarity on the economic outlook, mortgage rates tend to follow—and right now, they’re pointing downward.

Why Buyers in The Woodlands Should Pay Attention Now

This isn’t just a headline—it’s real money back in your pocket. Lower mortgage rates reduce your monthly payment when you buy a home.

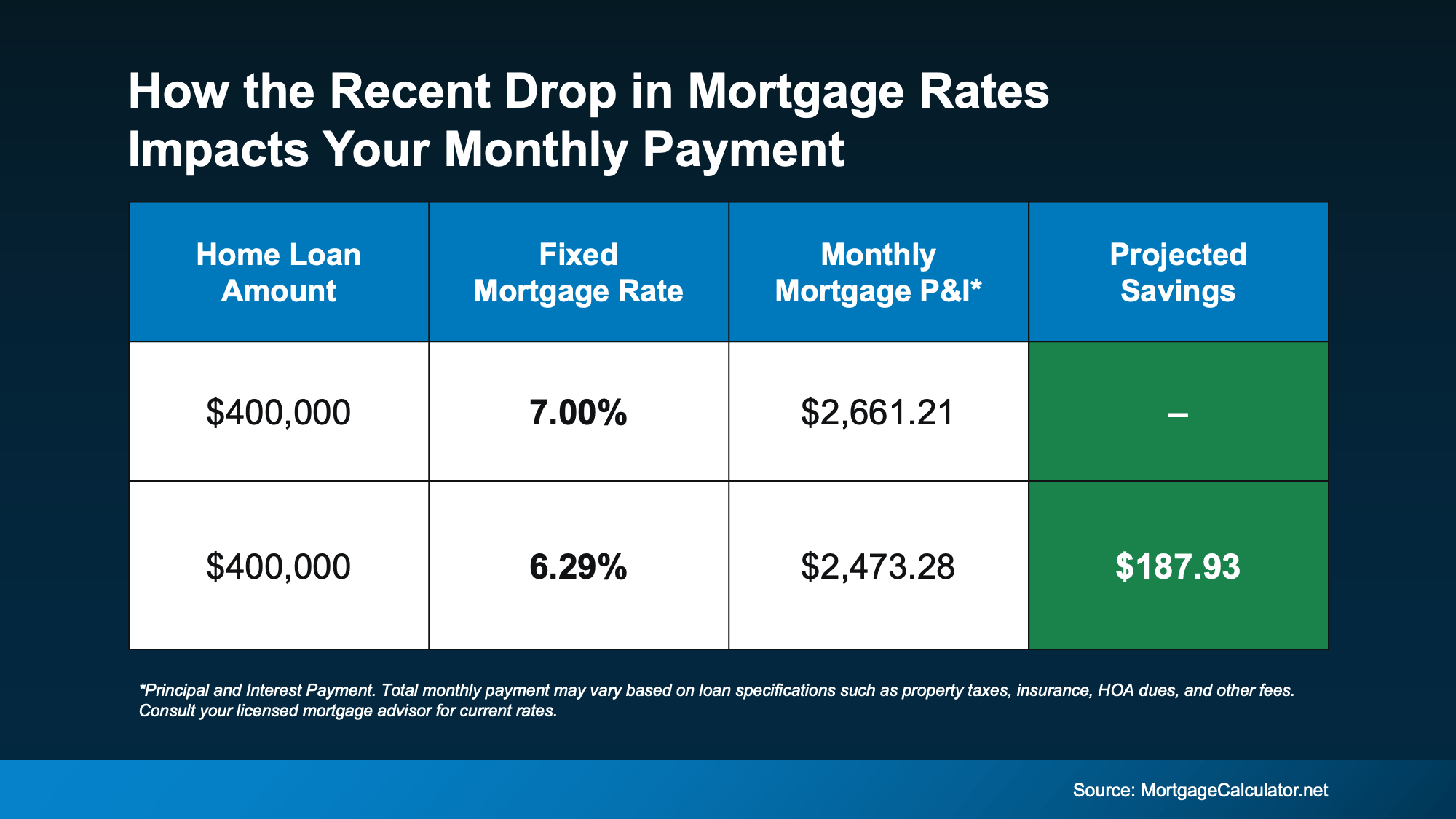

Here’s an example: compared to May, when rates were around 7%, today’s rates could save you nearly $200 per month—that’s close to $2,400 a year in savings.

For many buyers in The Woodlands, that shift is the difference between feeling stuck on the sidelines and finally being able to move forward with confidence.

How Long Will It Last?

The answer depends on the direction of the economy and inflation in the months ahead. Rates could continue to trend downward, or they may climb again slightly.

That’s why it’s smart to stay connected with a knowledgeable real estate agent and trusted lender. With The McClung Group by your side, you’ll have guidance on:

-

Inflation reports

-

Job market updates

-

Federal Reserve policy shifts

These factors will shape where mortgage rates go from here.

For now, the important thing is this: after months of stagnation, rates are finally breaking out of the high 6% range. As CNBC’s Diana Olick notes:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

That shift brings more opportunity for buyers than we’ve seen in quite some time.

Bottom Line

Mortgage rates just saw their biggest drop in over a year. If they remain near this level, a home that felt out of reach just a few months ago could now be within your budget.

Wondering how much today’s rates could save you on your monthly payment? Let’s connect at The McClung Group and run the numbers together so you can take the next step toward homeownership in The Woodlands.

.png)