Categories

Home SellersPublished December 23, 2025

Headlines Have You Worried About Your Home’s Value? Read This.

Are home prices really falling, and should you be worried about your home losing value?

The short answer: no, not in the way the headlines suggest. While a few local markets have seen slight price adjustments, home values are not declining nationally. In fact, most homeowners are still sitting on strong long-term gains—and the data tells a much calmer, more accurate story than the news cycle does.

If recent headlines have made you uneasy about your home’s value, here’s what’s actually happening and why context matters more than clicks.

Why the Headlines Feel Scarier Than Reality

Media headlines are designed to grab attention, not provide nuance. When even a handful of markets show small price dips, that gets amplified into a narrative that sounds like a nationwide downturn. But real estate has always been hyper-local, and broad headlines often gloss over that reality.

What’s happening in one state—or even one city—doesn’t automatically reflect what’s happening everywhere else. That distinction is critical when you’re thinking about your own home’s value.

The truth is, national home prices are not falling overall. They’re simply growing at a slower, more sustainable pace than during the rapid run-up of the pandemic years.

What the Data Actually Shows About Home Prices

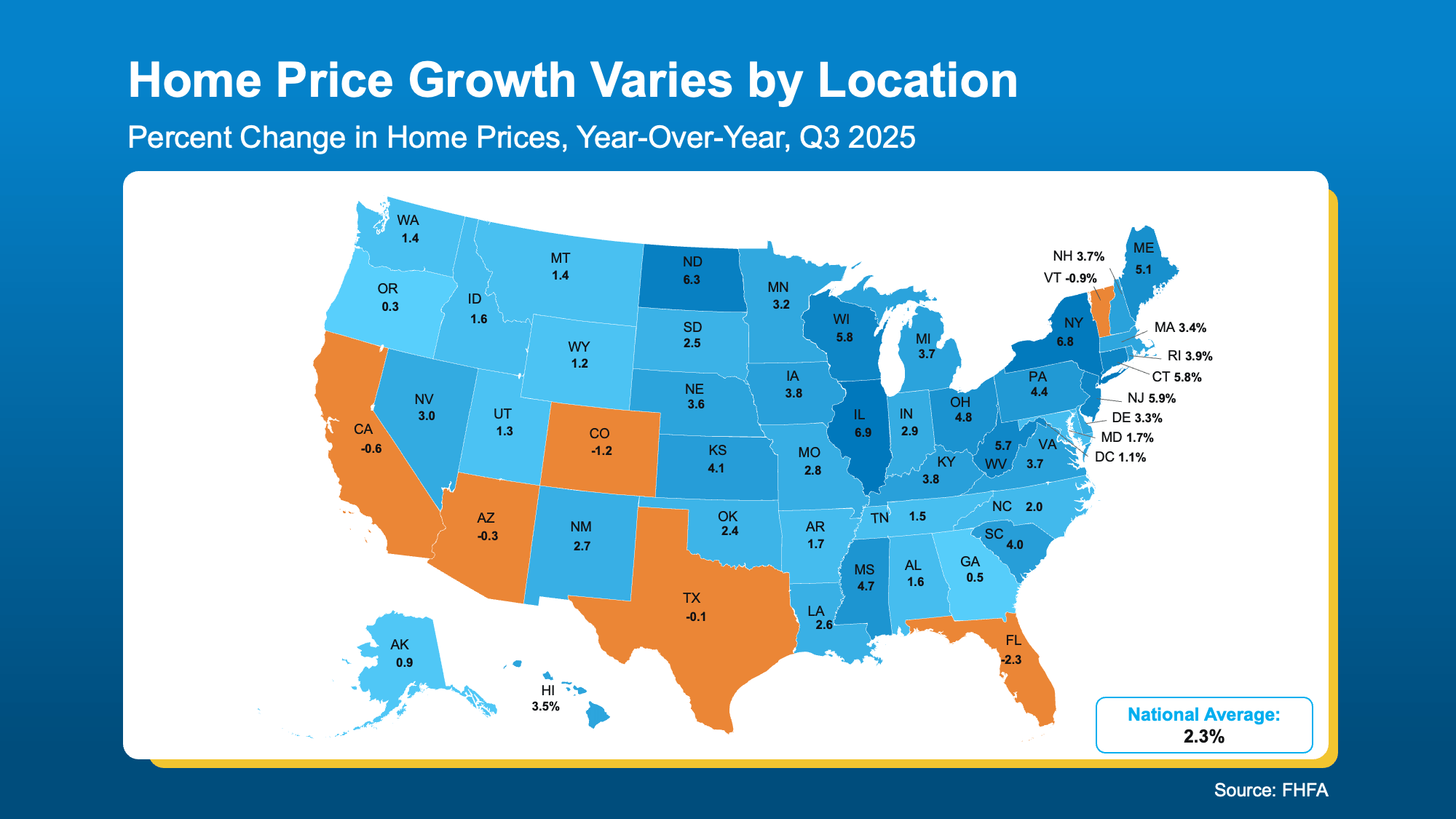

Year-over-year data from the Federal Housing Finance Agency (FHFA) paints a much clearer picture than most headlines do.

Most states are still seeing price growth. That growth may not be as dramatic as it was a few years ago, but it’s growth nonetheless. According to data from the National Association of Realtors (NAR), national home prices are up 2.1% compared to last year.

That matters, because it confirms something important: the housing market is normalizing, not collapsing.

A slower pace of appreciation after several years of rapid increases is not a warning sign. It’s a return to balance.

What About the States Seeing Price Dips?

Yes, there are some states where prices have dipped slightly over the past year. That’s the part most headlines latch onto. But context makes all the difference.

In those areas:

- The declines generally range from -0.1% to around -2%

- The markets experiencing these dips are often the same ones that saw prices spike the fastest during the pandemic housing boom

In other words, these areas aren’t crashing. They’re correcting after unusually rapid growth.

This kind of adjustment was expected. When prices rise too quickly, a period of leveling off often follows. That’s not a failure of the market—it’s how markets regain equilibrium.

Why Normalization Is Not a Bad Thing

During the pandemic, home prices surged at a pace that wasn’t sustainable long term. While that growth benefited homeowners, it also created affordability challenges and market strain.

What you’re seeing now is a healthier pattern:

- More measured price growth

- Less volatility

- More predictability for buyers and sellers

For homeowners, this means stability. For the broader market, it means fewer extremes. And for anyone thinking long-term, that’s a positive shift.

Most Homeowners Still Have Significant Equity

Even in areas where prices have softened slightly, most homeowners are still far ahead of where they started.

Data from Zillow reinforces this point:

- Only about 4% of homes are worth less than what the owner originally paid

- Roughly 96% of homes are still worth more than their purchase price

That’s not a market in trouble. That’s a market with deep, widespread equity.

When you zoom out beyond a single year and look at longer-term trends, the picture becomes even clearer.

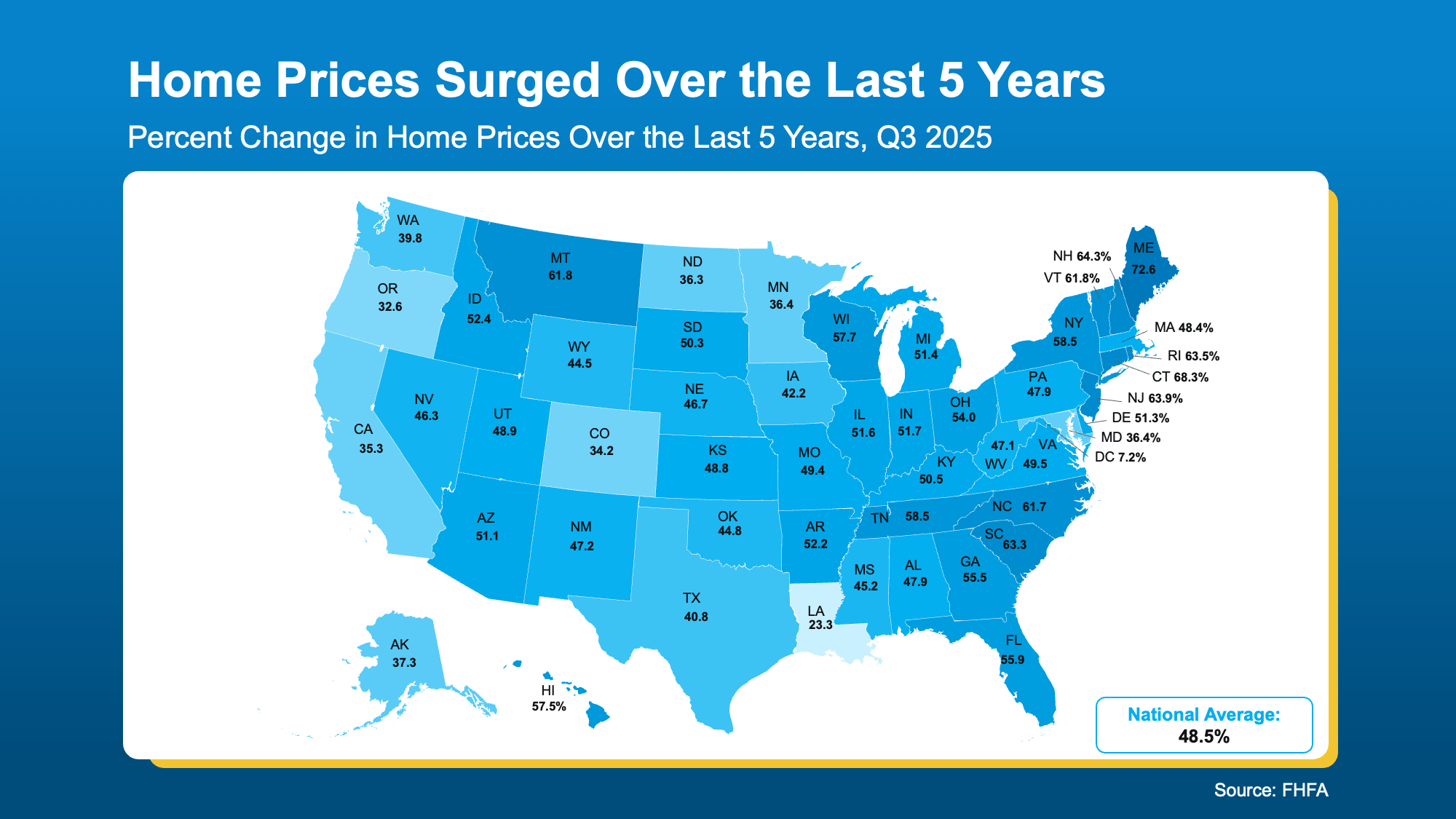

The Five-Year Perspective Changes Everything

Short-term fluctuations can feel alarming if you’re only looking at recent headlines. But real estate rewards patience, and history backs that up.

Over the past five years:

- National home prices are up nearly 49%

- Almost every market experienced double-digit growth during that time

That level of appreciation creates a substantial cushion. Small year-over-year dips in select areas are easily absorbed when values have risen that much overall.

This is why many homeowners remain in strong financial positions, even as the market adjusts.

Why Your Local Market Matters Most

National data provides reassurance, but your local market tells the most relevant story. Inventory levels, buyer demand, pricing trends, and days on market can vary significantly from one area to another.

That’s why understanding what’s happening locally is far more useful than reacting to national headlines.

As realtors with The McClung Group serving The Woodlands, we focus on what the numbers actually show in your market—not what grabs attention on a news ticker. Local insight helps you make informed decisions, whether you’re staying put, planning ahead, or considering a move.

If you’re unsure how current trends apply to your specific situation, a personalized conversation can bring clarity quickly.

What This Means for You as a Homeowner

If you’re hearing talk of price drops or crashes, here’s the grounded takeaway:

- Home prices are not collapsing nationwide

- Most markets are still appreciating, just more slowly

- Small dips in select areas reflect normalization, not instability

- The vast majority of homeowners remain well ahead thanks to long-term gains

In practical terms, your home’s value is likely far more resilient than the headlines suggest.

Final Takeaway

Headlines thrive on extremes, but the housing market is rarely that simple. A closer look at the data shows a market that’s stabilizing, not unraveling.

Most homeowners are still sitting on meaningful equity, and long-term price growth continues to outweigh any recent softening. Understanding what’s happening locally—and over time—matters far more than reacting to short-term noise.

If you want a clearer picture of what these trends mean for your home and your plans, a quick conversation can go a long way.

Ready to Talk About Your Local Market?

If you’d like to understand how current market conditions are impacting home values in The Woodlands, schedule a call with The McClung Group. We’ll walk through the local data, answer your questions, and help you see where you truly stand—without the headlines getting in the way.

.png)