Categories

Home BuyersPublished October 1, 2025

Downsizing Without Debt: How More Homeowners Are Buying Their Next House in Cash

Is downsizing the key to living mortgage-free in your next chapter?

More and more homeowners are discovering they can sell their current home and buy their next one outright—no loan, no monthly payments. If you’ve owned your home for a while, you may be in a position to do the same.

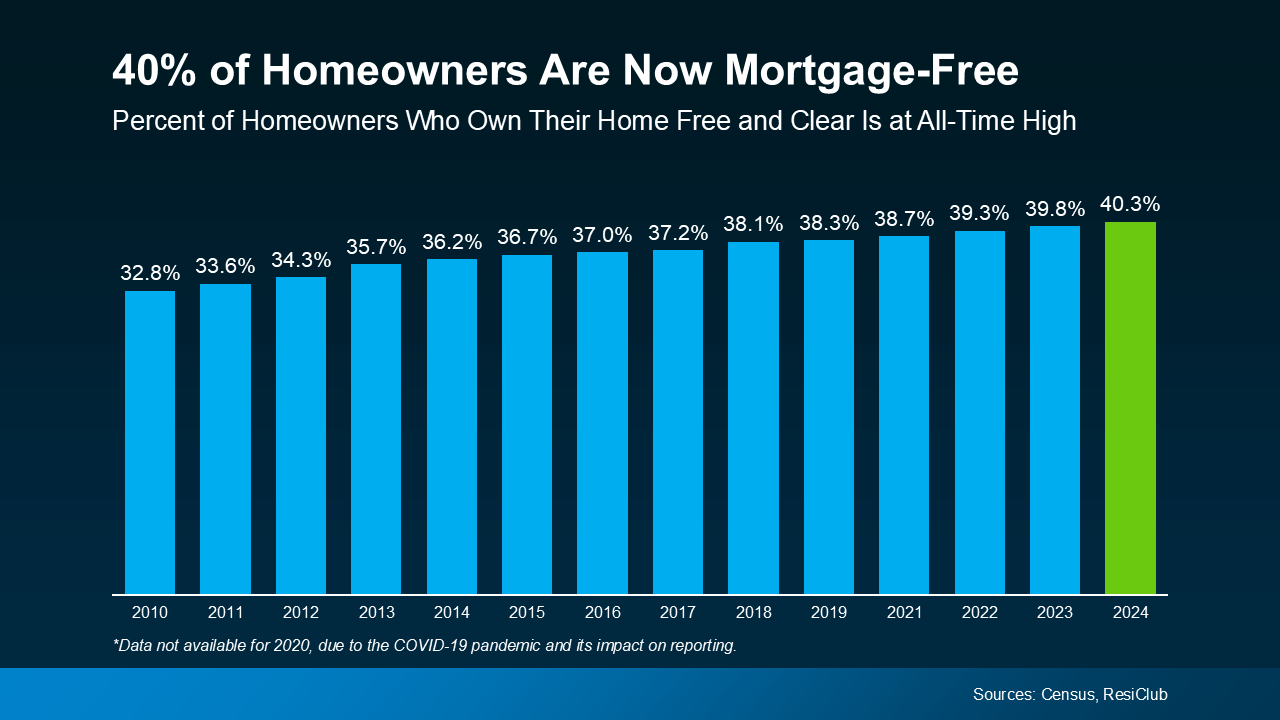

A Record Share of Homeowners Are Mortgage-Free

According to ResiClub’s analysis of U.S. Census data, over 40% of owner-occupied homes in the country are mortgage-free—an all-time high. That means 4 in 10 homeowners now own their homes outright.

A major factor behind this trend is demographics. Many Baby Boomers who’ve stayed in their homes for years have fully paid off their mortgages. For these homeowners, the equity they’ve built creates new opportunities when it’s time to downsize.

How Downsizers Are Turning Equity Into Buying Power

Your home equity is one of your greatest financial assets. If you’re mortgage-free—or close to it—you could use your equity to purchase your next home in cash. Here’s what that means for you:

-

Freedom from monthly payments: Stay mortgage-free into retirement.

-

More cash flow: Downsizing to a smaller, less expensive home frees up money for other goals.

-

Simpler transactions: Cash buyers often move faster and avoid financing delays.

The process is straightforward: sell your current house, then use the proceeds to purchase your next one outright. While it might sound out of reach, today’s market data shows it’s happening more often than you think.

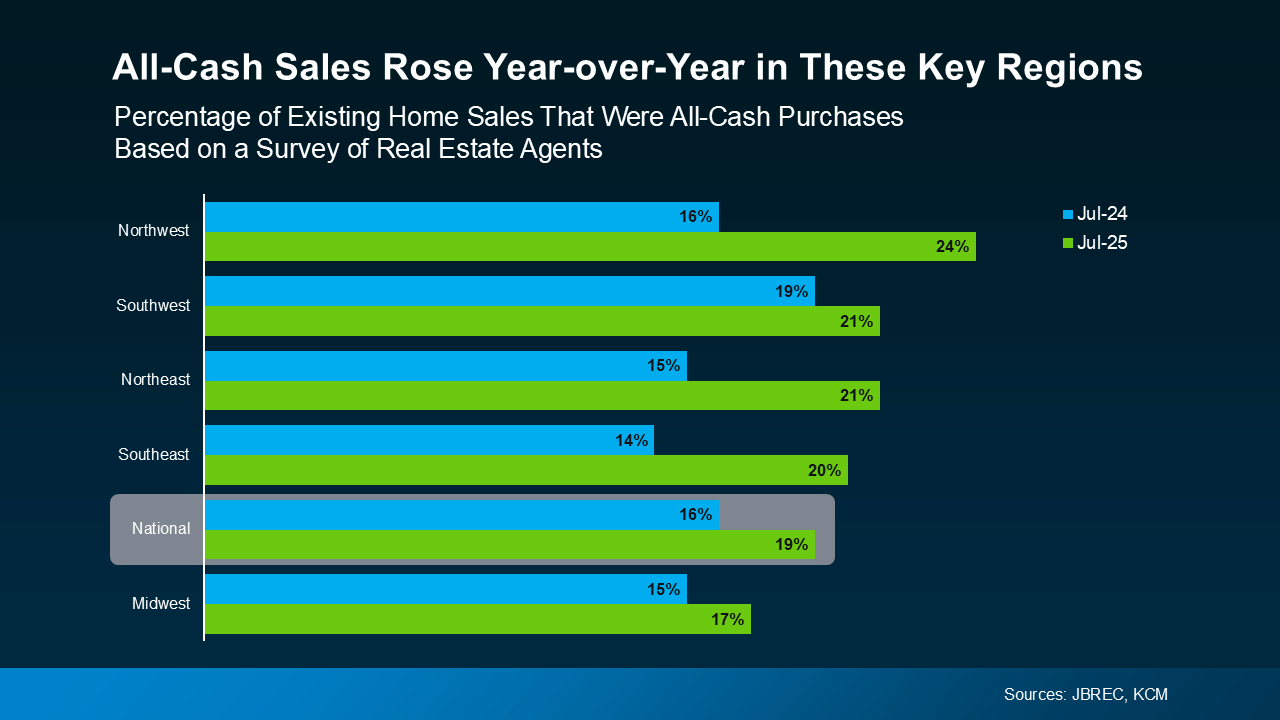

Cash Purchases Are On the Rise Nationwide

In a recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM), real estate professionals reported an increase in all-cash transactions across nearly every region of the country. That means more buyers—especially downsizers—are leveraging their equity to avoid taking on new debt.

For Baby Boomers especially, this strategy provides more control and peace of mind. Downsizing doesn’t mean downgrading—it’s about choosing a home that better fits your lifestyle with lower upkeep, less stress, and the financial flexibility to enjoy what matters most.

Bottom Line

You’ve worked hard to build equity in your home. Now it may be time to let your home work hard for you. Downsizing with cash could give you the freedom and flexibility you’ve been looking for.

At The McClung Group, we specialize in helping homeowners like you unlock their equity and find the right next home. Let’s start the conversation about what your house is worth and how it could fund your next chapter.

✅ Next Step: Schedule a call with The McClung Group today to explore your downsizing options and see what your equity can do for you.

.png)