Categories

Home BuyersPublished November 17, 2025

Are Builders Overbuilding Again? Let’s Look at the Facts.

Are builders overbuilding again, like they did before the 2008 housing crash?

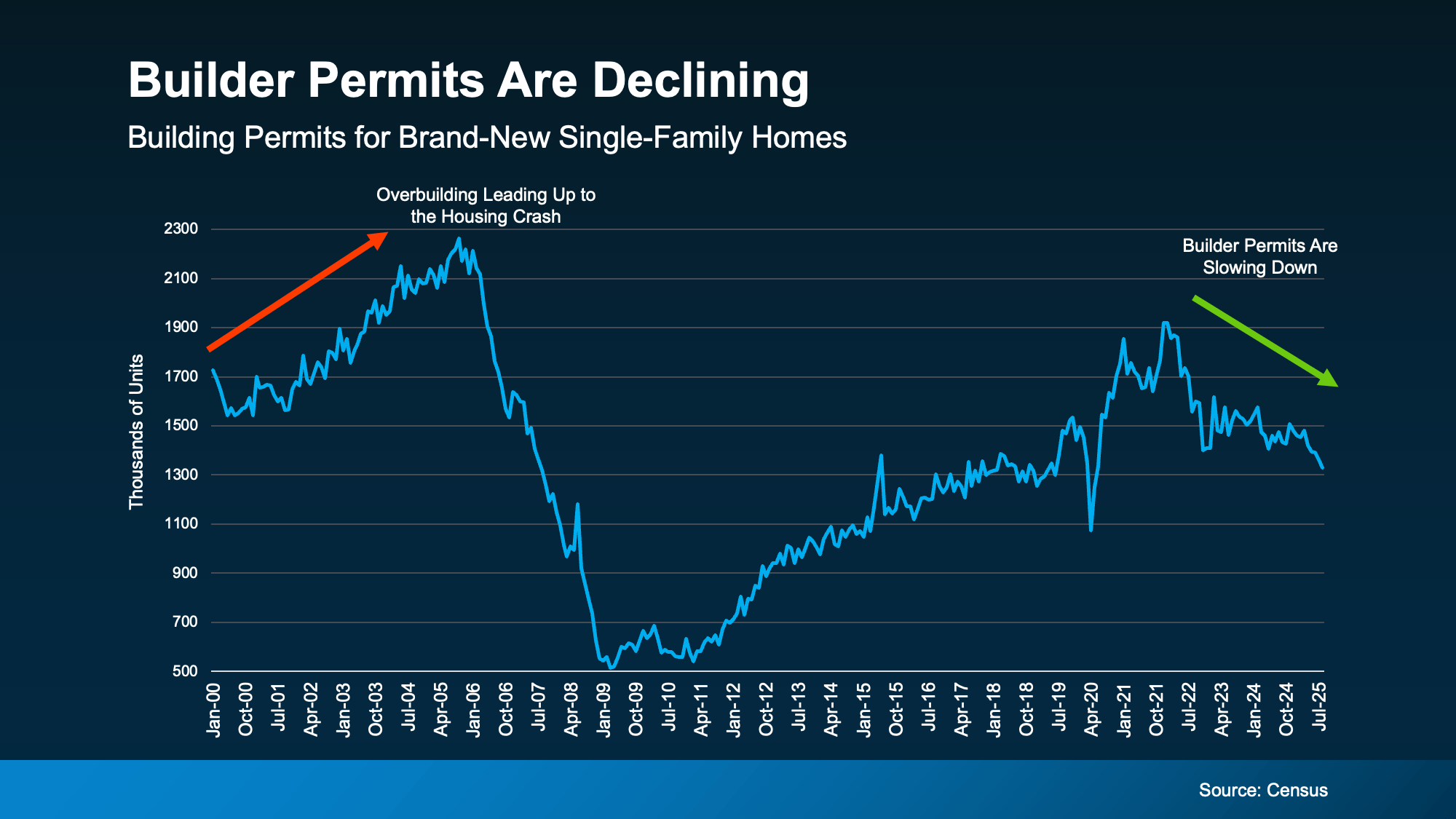

Despite what you may hear, builders aren’t overshooting the market. In fact, building permits have been declining for eight straight months, signaling a measured, intentional slowdown—not a risky construction surge.

What Today’s Numbers Actually Show

If it feels like new construction signs are everywhere, you’re not imagining things. Builders have been active, and more new homes are visible on the market. But visibility doesn’t equal oversupply, and it definitely doesn’t mirror the conditions that led to the 2008 housing crisis.

To understand what’s really happening, the best place to look is building permits. These are early indicators of future construction—and right now, they’re moving in one clear direction: down.

Before the 2008 crash, builders dramatically ramped up production, creating far more homes than the market needed. That imbalance was a core driver of the price declines many people remember.

Today is nothing like that period. While construction gradually increased after 2012 to meet long-standing shortages, the most recent data shows the opposite trend: builders are starting fewer homes right now.

According to the National Association of Home Builders (NAHB), single-family permits have declined for eight straight months—a clear sign of restraint.

Builders Are Slowing Down on Purpose

This isn’t a random cooldown. It’s a strategic move.

Builders are paying close attention to buyer demand, interest rate trends, and overall economic signals. Instead of pushing forward at full speed, they’re protecting themselves—and the market—from an oversupply scenario.

Ali Wolf, Chief Economist at Zonda, explains it clearly:

“...builders are still working through their backlog of inventory but are more cautious with new starts.”

This measured approach is the opposite of what happened before the 2008 downturn. Back then, builders kept building aggressively even as demand dried up. Today, they’re proactively adjusting before the market becomes unbalanced.

The Regional Trends Back This Up

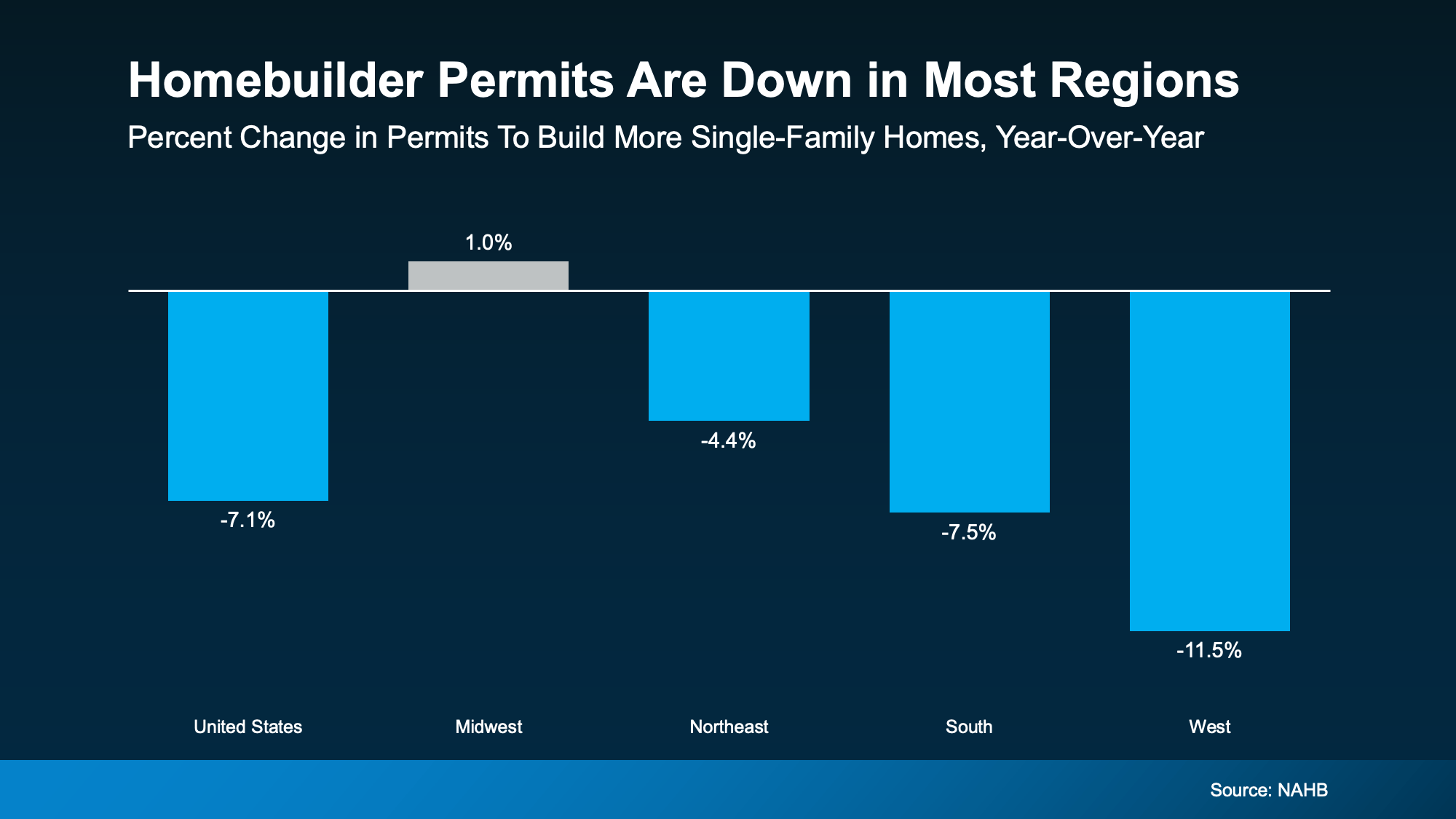

Even when you zoom out to regional data, the pattern is remarkably consistent.

NAHB reports that single-family permits are down in nearly every region of the country. Only one area shows a slight increase—and the growth there is so minimal it barely registers. In other words, we’re not seeing runaway construction anywhere on a meaningful scale.

Why This Isn’t 2008 All Over Again

The major difference today is intentionality.

Before the crash, builders kept adding supply even when the market clearly didn’t need it. Demand disappeared, inventory piled up, and prices had nowhere to go but down.

Today, the country is still short millions of homes after a decade of underbuilding. Even with more new construction on the market than a few years ago, it’s nowhere near excess. Demand remains strong, and buyers finally have more options after years of limited choices.

By pulling back now, builders are preventing the kind of oversupply that could create instability. They’re moving with caution, not overconfidence.

Bottom Line

Seeing more new homes for sale doesn’t mean builders are overbuilding. With single-family permits down for eight consecutive months and builders intentionally moderating new starts, the national market is on balanced footing—not headed toward an oversupply problem.

If you want a clearer picture of how new construction trends are shaping the market here in The Woodlands, our team can walk you through what’s happening locally and what it means for your plans.

Ready to Talk Strategy?

If you’re thinking about buying, selling, or exploring new construction, schedule a call with The McClung Group. We’ll help you understand the shifts, timing, and opportunities so you can move confidently in today’s market.

.png)